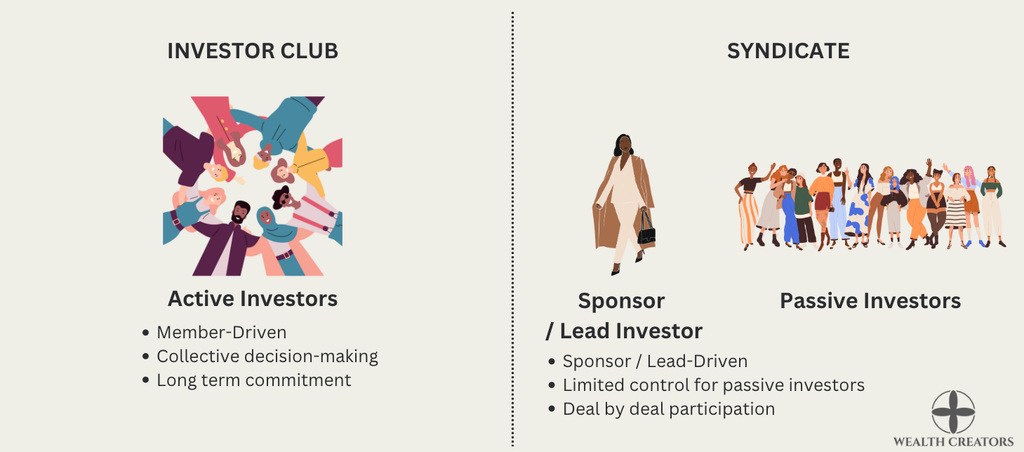

Investment clubs are groups of people who pool their capital to invest together, share ideas, learn together, increase buying power, share risk, and reduce transaction costs. They invest in startups, debt instruments, real estate, art, collectibles, and digital assets.

Since investment clubs are member-driven, virtually any community can create one — and they’re generally not regulated by the SEC provided that they follow certain guidelines. For example, they can have up to 99 members, are invite-only, do not charge carry, and require everyone to participate in investment decisions.

Key qualities of an investor club include:

- Collaboration: Members work together to identify and evaluate investment opportunities.

- Diversification: Clubs typically invest across multiple asset classes to spread risk.

- Education: Clubs provide opportunities for members to learn about investing.

- Network: Members benefit from shared knowledge and connections within the club.

- Transparency: Clubs maintain openness and honesty in decision-making processes.

- Long-term Focus: Clubs aim to generate sustainable returns over time.

- Governance: Clear structures and guidelines ensure smooth operation and decision-making within the club.

- Community: Clubs foster a sense of belonging and camaraderie among members.

No-nos for an investor club include:

- Sole Management: Investor clubs cannot be managed by a single individual; decision-making should involve all members.

- Lack of Transparency: Clubs should not withhold information from members regarding investment decisions or financial matters.

- Lack of Diversification: Clubs should avoid concentrating investments in a single asset or sector to minimize risk.

- Conflict of Interest: Members should refrain from using club resources for personal gain or promoting their own interests over the group's.

- Insider Trading: Members should not engage in unethical or illegal trading practices based on privileged information.

- Lack of Governance: Clubs should establish clear rules and procedures for membership, voting, and decision-making to avoid disputes.

- Excessive Risk-Taking: Clubs should not pursue overly speculative or high-risk investments without thorough evaluation and consensus among members.

- Lack of Compliance: Clubs should adhere to relevant regulations and legal requirements governing investment activities.

Our product helps friends and family create and manage a club from one place via our investor club portal. Prepare to take your investor club to the next level and get started today!