The wealth gap in the United States is a persistent issue, with Black households struggling to access capital and holding disproportionately low amounts of equity investments. This disparity has led to a situation where only about 33% of Black households, approximately five million, hold equity investments compared to over 60% of White households. The issue extends to entrepreneurship, where in Q3 of 2023, Black founders received less than 0.13% of funding. While these statistics paint a bleak picture, it's crucial to focus on solutions. One promising approach to bridging the wealth gap is through community investing and promoting equity ownership, particularly in private markets. Wealth Creators, a pioneering community, is leading the way in this endeavor.

The Wealth Gap and Equity Investments

The wealth gap, characterized by the significant disparity in assets and income between Black and White households, is a complex issue rooted in systemic challenges. One of the key factors contributing to this gap is the lack of access to capital and equity investments among Black households. Equity investments, including stocks, mutual funds, and business ownership, are crucial for wealth creation and long-term financial security. However, systemic barriers and historical inequalities have limited access to these wealth-building opportunities for many Black families.

The Need for Change

To address the wealth gap, it's imperative to increase the number of Black households investing in equity and launching businesses. Equity investments provide a means to grow wealth over time, benefiting from compound interest and the potential for asset appreciation. Entrepreneurship, on the other hand, offers a pathway to financial independence and community economic development. By focusing on these areas, the goal is to shift the economic narrative and create lasting change.

Wealth Creators: A Movement for Change

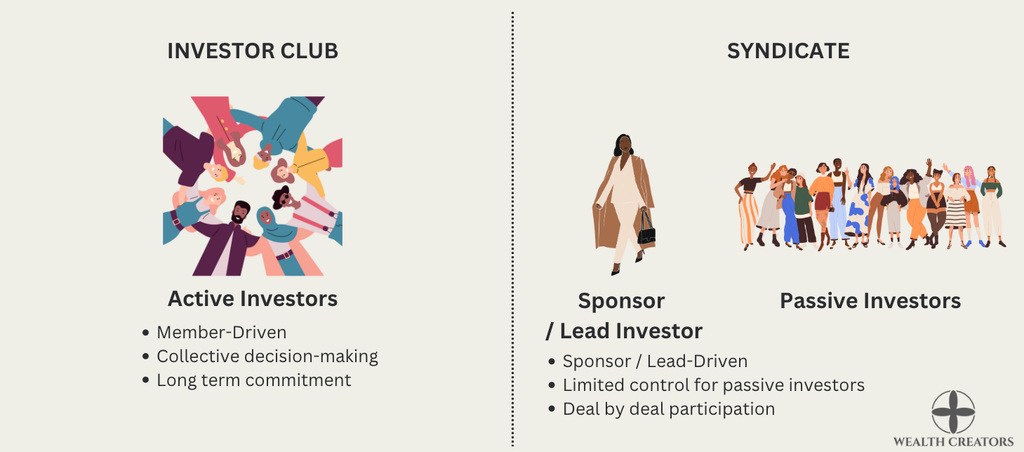

Wealth Creators is a community focused on addressing these challenges by leveraging the power of collective investing. The organization operates on the principle that community investing can be a powerful tool for economic empowerment. By pooling resources and investing in private markets, Wealth Creators aims to foster equity ownership among Black households and promote entrepreneurship.

Focus on Equity Ownership

Wealth Creators prioritizes equity ownership as a key strategy for building wealth. Through investments in private markets, the community provides members with opportunities to own stakes in businesses and ventures that align with their values and interests. This approach not only helps individuals grow their wealth but also promotes a sense of ownership and agency in economic affairs.

Community Investing

In a capitalist economy often characterized by individualism, Wealth Creators emphasizes the importance of community and collective action. The organization encourages members to invest together, pooling their resources to access opportunities that might otherwise be out of reach. This approach leverages the power of the collective to create economic opportunities and support ventures that benefit the community.

Empowering Entrepreneurs

Entrepreneurship is a key focus for Wealth Creators, recognizing the potential for business ownership to drive economic development and wealth creation. The organization supports Black entrepreneurs by providing funding, mentorship, and networking opportunities. By fostering entrepreneurship, Wealth Creators helps to create jobs, stimulate local economies, and build generational wealth.

Sparking a Movement

Wealth Creators is more than just an investment community; it's a movement aimed at shifting the wealth gap and creating lasting change. By focusing on equity ownership and community investing, the organization is challenging the status quo and demonstrating the power of collective action. The goal is to create a ripple effect, inspiring more individuals and communities to invest in their futures and work towards economic equality.

The Power of Community

The ethos of Wealth Creators is grounded in the power of community. The organization believes that by working together, individuals can achieve more than they could alone. This principle is evident in the community's approach to investing, where members collaborate to identify opportunities, share knowledge, and support each other's financial goals. This collaborative spirit fosters a sense of belonging and mutual support, creating a strong foundation for economic empowerment.

A Vision for the Future

Wealth Creators envisions a future where more Black households have access to equity investments and entrepreneurship opportunities. The organization is working towards a future where economic empowerment and financial literacy are the norm, and where communities can thrive through collective action. By focusing on solutions and fostering a movement for change, Wealth Creators is playing a vital role in bridging the wealth gap and creating a more equitable society.

Conclusion

The wealth gap remains a significant challenge, but organizations like Wealth Creators are paving the way for change. By focusing on equity ownership and community investing, Wealth Creators is addressing the systemic issues that have limited economic opportunities for Black households. Through collective action and a focus on solutions, the organization is sparking a movement that has the potential to transform the economic landscape and create a brighter future for all. In a world where economic inequalities persist, Wealth Creators serves as a beacon of hope, demonstrating the power of community and the potential for change through collective investing and entrepreneurship.